Defence Policy

Falling oil prices: challenges and perspectives for European energy/gas security

Oil prices have fallen from $105 to $30 in a little bit over a year. As a result gas prices which are closely linked with oil prices have strong trend to decline. Falling oil prices is good news for oil importers, such as Eastern Europe, however, it is bad news for oil exporters, such as Russia. The period of low energy prices is a favorable period for the implementation of know-how, market development and sectoral transformations and as well as it is period for rethink European energy strategy.

Decline in oil and gas prices and new natural gas projects

After some years of relative stability, oil prices have dramatically fallen since mid-2014, reaching a level below $30 a barrel at the beginning of 2016. Oil prices have collapsed 70 % over the past two years. Decline in oil prices has a direct impact on the pricing situation on the market of natural gas. As a result global natural gas market has already felt some impact from the slide in oil prices. Nevertheless, today European gas market is primary indexed by hub prices, which are separated from oil prices. At the same time, the most volumes of natural gas are purchased by European countries according to long-term contracts, which are governed by oil prices.

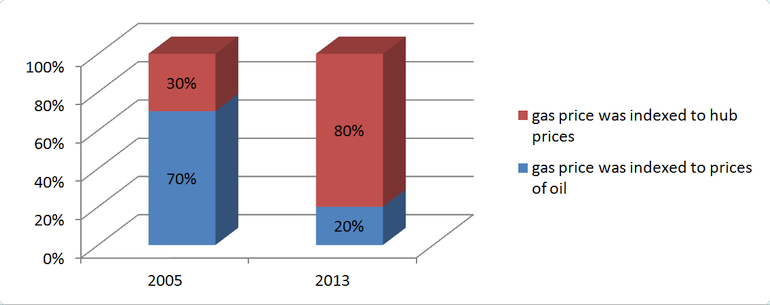

Fig. 1 Gas prices were indexed to prices of oil VS hub prices[1]

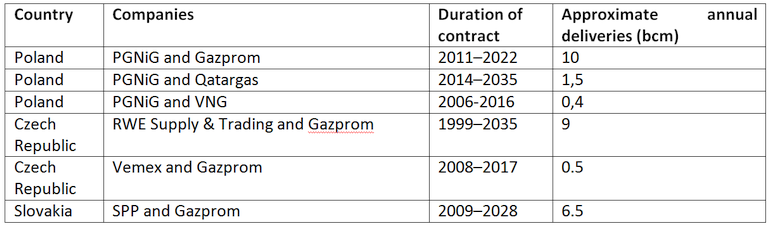

For the past period of time the interdependency between oil and gas prices has substantially changed on the European market. This is directly reflected on the transformation of the indexation approach of gas contract. The natural gas long-term contracts of Visegrad countries remain indexed to oil prices, the fall in oil price directly impact on gas contract prices. Russia’s Gazprom as a key supplier to the European market justified the necessity to sign oil-indexed long contracts by their significant expenses on production and transport infrastructure and also that the searches for oil and natural gas often run in parallel. However, over the past several years the conditions of long-term contracts have been renegotiated with the European buyers. Gas customers could achieve a renegotiation of the terms of delivery and also the gas prices. As a result Gazprom renegotiated its contract with Poland’s PGNiG, the Slovak company SPP, the Czech division of RWE Supply & Trading, and, among others.

Table 1 - Long-term contracts for gas delivery to Visegrad states

Considering the development of European spot gas market and as well as increase in the capacity of LNG-terminals it is obvious that the interpretation of concept “take or pay” should be renegotiated and the market indexation should be entered. As a result the buyers could optimize their purchases of natural gas between long-term contracts and purchases of gas from traded hub. If the long-term contracts between Gazprom and energy companies of Visegrad states have been moved to hub price indexation the customers may choose between these two sources. In addition it means that the European gas companies should be able to have a greater ability to reduce the purchasing of gas volume or independently control the gas volume of purchases.

Actually, 2015 was quite difficult for the oil and gas industry worldwide. The major decline in oil prices caused volatility and resulting of reduction investment in gas production. According to estimates of consulting company Wood MacKenzie, in 2016-2020 the oil and gas companies will postpone implementation of the projects by $380 billion. Also, mentioned consulting firm identified 68 large oil and natural gas global projects with a combined value of $380 billion, that have been put on hold around the world since prices started coming down, halting the production of 2.9 million barrels a day[2].

If low oil prices persist for a long time, the number of pipeline projects will be reduced worldwide, like all other infrastructure projects. Their cost recovery directly depends on the oil prices and, naturally, the level of the transmission tariffs. It means that new infrastructure project can be freezing with a high probability. Also, low gas prices may force the European authorities to abandon the investment in infrastructure for the delivery of liquefied natural gas.

Decline in oil and gas prices and new shale gas projects

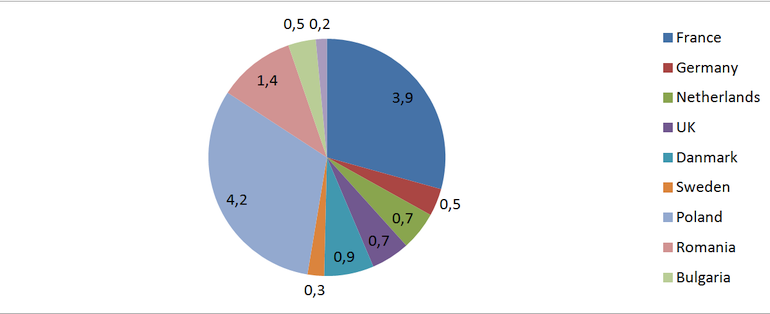

According to the report of Germany’s Federal Institute for Geosciences and Natural Resources (2013), the shale gas reserves in Europe were estimated at 14 trillion cubic metres (tcm). It is greater than Europe’s natural gas reserves which were estimated at 5.2 tcm. Under the report Poland has the biggest shale gas resources in Europe and was called as “Qatar of Central Europe”.

Fig. 2 Unproved technically recoverable shale gas resources[3]

Nevertheless, only a few explorations have been drilled on the European space up to date, that’s why it is too early to talk about “shale revolution” in Europe. Shale gas production certainly has prospects, but they depend, primarily, on how profitable such projects will be. At least it needs about six years before shale gas production will become commercially feasible. Many companies which invested in production of Polish shale gas about $780 billion during last 4 years have abandoned their projects. At the end of 2014 seven from eleven gas production companies have given up to work in Poland, between them Eni, ExxonMobil and Total. Evidently the shale gas projects could be rather attractive for the investment before falling in oil prices. At any rate technical feasibility of shale gas production in Europe is proved, but commercial attractiveness of these projects still remains controversial. The collapse of oil prices has turned the shale gas projects unprofitable and commercially impractical.

A sharp drop in prices for “black gold” has led to a significant reduction of income for many participants of energy market. The cost of gas transit depends on many factors including the price of natural gas. Therefore, the profit of many European gas transportation companies may fall.

Decline in oil and gas prices and decarbonization projects

Following the “20-20-20 Plan”, in 2014 the European Council adopted a new policy framework with ambitious targets of decarbonization to be met by 2030: at least a 27% share of renewable energy sources (RES) in gross final energy consumption; and at least a 27% reduction in final energy consumption compared to estimates. The 2030 framework also proposes a new governance framework based on national plans and a set of key indicators to assess progress over time[4].

The falling oil prices will have some impact on decarbonization of economy, but it is quite limited because the price is not the only driver for decarbonization. For instance, natural gas will follow the downward trend in the oil prices. No doubt that natural gas is an important fuel, so the projects of decarbonization can have a low cost in a certain period of time. It is worth noting that it can speed up the implementation of the decarbonization projects.

Decline in oil and gas prices and the European energy strategy of Russia

Low oil prices prompted Russia to change its gas strategy on the European space. Today it is rather important for Gazprom to maintain its part in gas market in terms of massive supplies of American liquefied natural gas (LNG) to European partners. Due to falling of oil prices Russia has already suffered the losses. However, today, a key goal of Gazprom is to keep its share on the European gas market and, possibly, using the tools of price dumping, to expand one. Such Gasprom’s strategy can consist of the decrease in gas price for European consumers to such a level that exporting LNG from USA will be unprofitable. As a result Russian monopolist could defend its market share in the European region that accounts for the bulk of its profit. Evidently Russian damping strategy on the European gas market may have significant effects for the global gas market, - threatening the capability of the emerging American LNG industry and global energy market. It is quite probable that Gazprom will use early approved strategy of the “selective discounts”. For example, it may offer a special discount program of gas prices for selective European states. Consequently, it could have a negative influence on the European solidarity, strengthening the discussion between the EU states and slackens the pace of creation of the Energy Union. Therefore, the European officials need to think through their strategies carefully if they hope to benefit from low energy price.

Dr. Nataliia Slobodian, energy expert

National Center for Strategic Studies, (Poland, Warsaw)

[1] https://www.bcgperspectives.com/content/articles/energy_environment_low_oil_prices_challenging_natural_gas_markets/

[2] http://www.reuters.com/article/oil-production-cuts-idUSKCN0US07N20160114

[3] P. Szalai, “Gas in Central Europe: From Russia to Qatar And Back“, V4 Revue, 20 August 2012, retrieved 24 March 2014, http://visegradrevue.eu/?p=1016.